Building a new house or renovating a home isn’t cheap, so it is perfectly natural for homeowners to seek out the best deal possible. However, when a building contractor is offering you a deal that seems too good to be true…it probably is.

You’ve likely heard the stories about people hiring a general contractor who did faulty or incomplete work, didn’t build everything to code, hired terrible subcontractors, failed to provide the expected service, or - even worse - took the payment and disappeared off without finishing the job. These nightmare scenarios are NOT just urban legends. Even worse, these contractors don't typically look as sleazy as the gentleman in our header photo.

To help you avoid being taken advantage of by shady contractors, we have compiled a short list of warning signs to look for when interviewing builders so that you know how to spot a deal that is just too good to be true.

Warning Sign #1:

The builder cannot produce a list of client references

The first step in deciding whom to work with is to compile customer reviews of all potential builders. As a general rule of thumb, you should consider only the builders that have multiple reviews from verifiable sources.

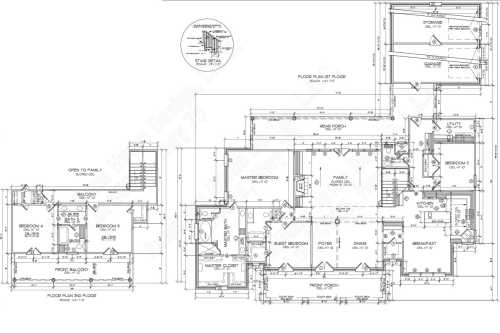

A new custom home is likely be the largest single investment most people make in their lives, and it is also the place where people spend the majority of their time. Therefore, it is imperative that the custom home be built to sustain its value while also providing the comforts & amenities that make life at home enjoyable. So before you ever decide on a short-list of builders, you have some homework to do.

In other words, you will want to see references of people who have actually used the services --- not just friends of the builder. Keep in mind that anyone can build a list of subcontractors for constructing a home. However, only true professionals have the experience which comes from years of working with different types of homes & clients, as well as successfully navigating the complexities of managing trades and client expectations. A builder with a trail of bad references is an obvious red flag. Sure, every business has it’s share of good projects and bad projects…but the bad ones should not be the majority of their work. Good builders are able to produce a list of references from recent projects.

Another indication that working with a particular builder may be problematic is their failure to pay his or her bills. That’s why you should look for references from some of the builder’s suppliers as well. Even though suppliers may be reluctant to give a bad report on someone they are trying to collect from, they will often be more than happy to let you know about a builder they have sent to collections.

Warning Sign #2:

The builder asks you, the client, to pull the building permit

In Louisiana, a building permit is required for new homes in EVERY jurisdiction. There is no exception to this requirement. This regulation, the New Home Warranty Act (NHWA), was enacted in part to ensure your home is built to code, is properly inspected, and that the person pulling the permit guarantees the structure will be constructed in compliance with building standards.

Essentially, the NHWA is in place so that a licensed and insured contractor - or at least a homeowner who is aware of the specifics outlined in the NHWA - is held accountable if certain defects are discovered in the structure soon after construction is complete. And while it is not totally unheard of for the homeowner to sign an AFFIDAVIT CLAIMING EXEMPTION FROM LICENSURE affirming that the signatory will 1) act as the supervising contractor, 2) will obtain the proper amount of builder’s risk, worker’s compensation, and liability insurance for this project, 3) the home will be built to code, and 4) the home will be constructed for personal use, anyone opting to sign that affidavit should be aware of the following:

Any contractor who is being hired to perform the work - yet requests that you pull your own building permit - is quite literally asking you to commit perjury. This is because you must attest to the following statement of fact when you sign the affidavit to pull the permit:

“S/he acknowledges that s/he will undertake and superintend the construction project, and that s/he will be prohibited from hiring an unlicensed subcontractor to superintend, manage, provide advice, or otherwise act as a contractor for this project.”

But if YOU are not actually going to be performing the supervision and oversee the project, then you would be falsifying a legal document and exposing yourself to fines, restitution to the state, or even imprisonment. (La. R.A. 14:133)

Warning Sign #3:

The builder asks you, the client, to pay a portion or all the bill to the subcontractors

A contractor is responsible for keeping detailed records of his Cost of Construction. This information is used to determine his insurance premium.

If a contractor chooses to leave certain costs out of their accounting records by asking the client to directly pay portions of the contractor’s bills, then that contractor isn’t reporting the full costs of construction to their insurance company. Therefore, if damages do occur during the course of construction, the insurance company may not be required to cover the full damages if a claim is made because the builder will not have paid the full premiums for the cost of the insurance.

Another consideration is that if you agree to pay certain subcontractors, any compensation disputes become your responsibility, and you will likely end up having to negotiate with the subcontractors directly.

We have presented these tips in order to help you identify some of the most egregiousness “red flags” that exist with shady contractors.

While it is common for homeowners to find a contractor who can give them a “deal” on a certain aspect of the construction or renovation project, the truth is that most of the material and labor costs are pretty standard in the industry. So, in reality, contractors who promise huge cost savings or “incredible deals” could be too inexperienced to realize they won’t be able to deliver on their promises, willingly manipulating the homeowner into assuming all the financial liability & risk, and/or taking dangerous shortcuts that could ultimately come back to haunt only the homeowner.

The truth is that credible, reputable and trustworthy contractors are very easy to identify because they share a few common traits, including:

- Ratings and reviews from actual past clients and subcontractors with whom they often work, are readily available online.

- They are financially stable and generally considered fiscally responsible.

- They won’t pressure homeowners into signing an affidavit that relinquishes their own accountability while significantly increasing the client’s exposure to risk.

- They will follow the industry standards for maintaining liability insurance and Workman's Compensation so that the contractor, the subcontractors, and the client are all duly protected.

If you have any tips you would like to share, email the author and you may see your tip added here!