"I want to build a new home! Now What?"

The decision to hire a contractor to build you a custom home from the ground up - rather than buying an existing house - isn't always an easy choice to make. But if you're willing to commit the appropriate amount of time, energy, and resources needed for this type of project, then the payoff will be well worth the effort!

There are many inherent benefits that come with building a custom home from scratch and tailored to your specifications. You get to pick out all the amenities, choose a color scheme you love, have a floor plan designed the way you've always wanted it, and even have the benefit of a quick appreciation in value. Now...to be very honest...the only way you get to that point is to make a few very wise decisions early on, and then properly prepare yourself for the construction process. This means you'll have to constantly focus on limiting unnecessary expenses caused by inexperience, avoiding delays due to skipping crucial steps in the process, and avoiding many common pitfalls that often force others to abandon their construction plans.

Taking the First Step: A Feasibility Review

A feasibility review is an essential tool that allows you to determine answers to 4 major questions:

1. What is my budget?

This is the most important question to address before making any other decisions as the answer will be the foundation everything else is built on! Start by answering these questions, then familiarizing yourself with some basic information about the type of loan you will need.

Think about a "feasibility review" as a more organized way of using your research to narrow down options so that you can make wise budgeting and planning decisions.

2. Where do we build our home?

This answer is extremely important because it may determine your actual options for size, style, amenities, and overall budget.

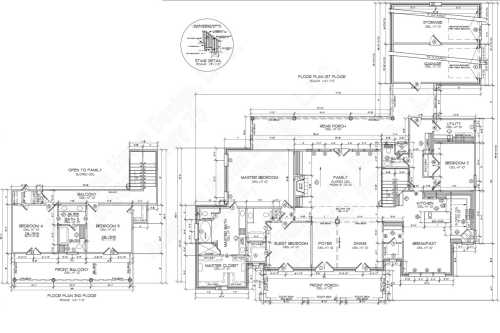

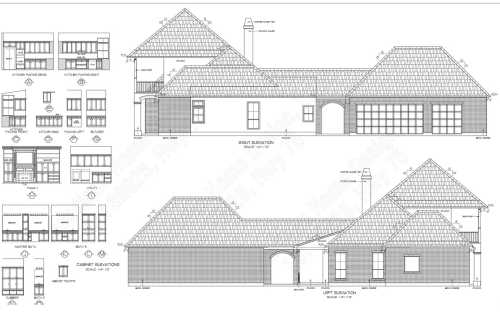

3. What will our house look like?

Basically, you want to narrow down your options to answer 'How Big, How Fancy, & How Much'.

4. What features & fixtures do we include?

You'll want to start considering many of the details of amenities that are included in your new home.

5. About how much will it cost?

Once you have answered the questions above, you should have a general idea of the costs involved. Setting the budget parameters as quickly as possible will also help avoid making common mistakes like purchasing a set of plans for a house that you cannot afford (See Designing House Plans).

These preliminary answers will become the foundation for many important decisions in subsequent steps. Start learning more about the Basics of Construction Loans by reading our article. Then make sure you download our handy Feasibility Review Checklist that will help you keep track of your notes during the process. Keep in mind that the answers you derive in the feasibility review may turn out to be wrong, or you may simply change your mind. Again...that is perfectly alright...just stay flexible and it will all work out!

Here are a few questions past clients have brought up that may help spark your own internal questions:

- 1 story or 2? Would a 1 story with a cozy loft on the 2nd floor be enough??

- How many bedrooms do I need, and will I need more in the near future?

- Will I need an office or study? Is that even important?

- Do I like "open" floorplans, or do I like walls & halls?

- Speaking of open floorplans...do I want the kitchen to seamlessly join with a breakfast nook? Or to a dining area? Or both???

- Speaking of kitchens, will we ever actually be professional chefs who need industrial appliances? Or, can we settle on semi-pro gear?

- If we build a huge living room, is anyone even going to spend time in there??

- Am I a morning person, or do I hate waking up? And should that influence where the master bedroom is placed?

- If our 10x10 storage unit is overflowing, does that mean I should focus on having plenty of storage space?

- Do I love taking baths more than I love having an enormous shower?

- Is a formal dining room a wise use of space?

Yes...it is an intimidating venture. Yes...there are several obstacles that you will encounter. Yes...you will make mistakes and there will be disappointments along the way.

And, Yes...it is usually worth all effort when you end up with a beautiful home that you were able to help create and build from concept to construction!

Article by Robert Carroll

Robert is a NAHB Certified Graduate Builder with Carroll Construction. Robert joined the team in 2007 after graduating from L.S.U. with a degree in Construction Management. Now as Chief Operating Officer, Robert Carroll is extremely active in the local builder community, a leader in the LHBA, and is an avid supporter of charity and community causes inside the Greater Baton Rouge area.