At this point in the process, you're about ready to start construction!

Months ago, you began the new construction process by completing a Feasibility Review, found land, decided on all the details of your home, chose a builder, drew up plans, developed a budget, and recently secured funding. Now, it is finally time to wrap up the paperwork and get started with construction! The only things left to do is ensure their investment is properly protected, close on the loan (which initiates a financial obligation), set the date to break ground, and begin thinking about how to manage the details of the construction phase.

Insurance on a Construction Loan

![]() In the article Choosing a Builder, we showed that the builder should have insurance policies which cover potential losses they would incur. We want to ensure you know that additional coverage is needed on a construction loan. For the protection of the borrower (and the lender's interest), a financial institution will typically require an insurance policy to cover any potential losses that would occur during construction. This coverage is called "builder's risk insurance" and offers protection while the home is being constructed. Typically, the borrower pays the premium, but the policy can be in the builder's name. The actual policy may not always be required to get the loan, however it will be needed prior to closing.

In the article Choosing a Builder, we showed that the builder should have insurance policies which cover potential losses they would incur. We want to ensure you know that additional coverage is needed on a construction loan. For the protection of the borrower (and the lender's interest), a financial institution will typically require an insurance policy to cover any potential losses that would occur during construction. This coverage is called "builder's risk insurance" and offers protection while the home is being constructed. Typically, the borrower pays the premium, but the policy can be in the builder's name. The actual policy may not always be required to get the loan, however it will be needed prior to closing.

Receiving a Loan Closing Date

Once you have received funding and signed the various contracts and agreements, You're Almost There! Up next is to set a date for closing the loan. Some people advise that it is best to get a closing date toward the end of the month so that you can avoid paying interest on a full month of the principal balance of the loan. Personally, we tell clients to get a date that works best for them.

Once you have received funding and signed the various contracts and agreements, You're Almost There! Up next is to set a date for closing the loan. Some people advise that it is best to get a closing date toward the end of the month so that you can avoid paying interest on a full month of the principal balance of the loan. Personally, we tell clients to get a date that works best for them.

Once you have that date, you should let your builder know as soon as possible so that he or she can initiate their internal process. Here at Carroll Construction, once we are alerted that a client has a closing date, we start notifying our sub-contractors that work will begin soon. This will help to ensure a quick start to the project.

Set a Start Date for Construction

Congratulations! Now that you have completed all the critical steps to prepare for building a custom home, IT'S TIME FOR THE REAL FUN TO BEGIN! You and your builder will now be coordinating on a variety of initial decisions, including building materials, color schemes, dates of availability, plumbing fixtures...and the list goes on.

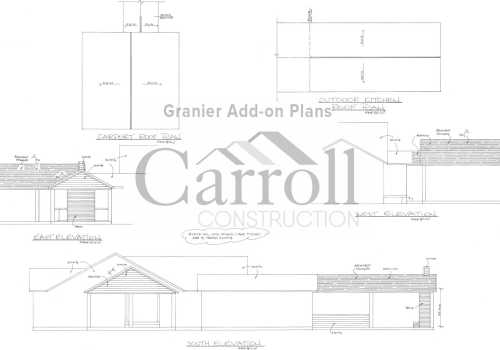

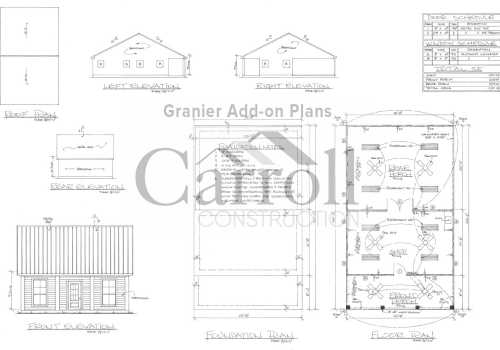

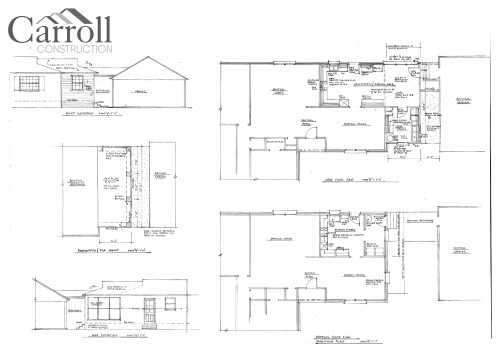

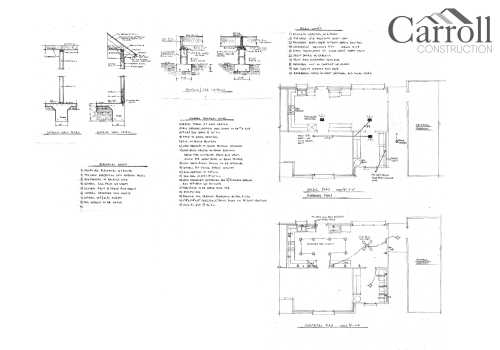

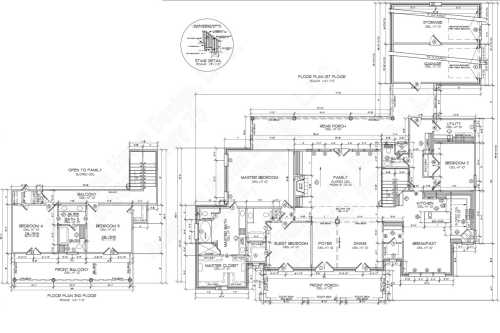

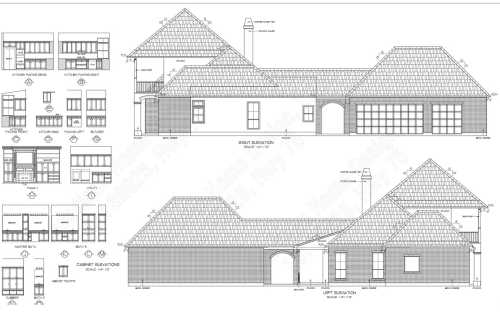

At this point with Carroll Construction clients, our design professionals would begin reaching out to you to begin making selections for you new home. Depending on several factors that may have been revealed during the process, your selections of features, fixtures and even exterior style may have changed or evolved. That's why we encourage clients to maintain a flexible mindset throughout the project. Good preparation early on means that if changes need to made at this point, there should be few surprises and a set of alternatives in place.

Managing Details During Construction

Once construction is in full swing, the day-to-day details and schedules may become tough to manage, so start considering solutions now.

As pointed out in Choosing a Builder, you should consider choosing a building contractor who offers an online tool for keeping track of all the details of the project. Carroll Construction's Project Management System is an online & mobile application that puts all the information about the construction project at your fingertips, plus provides a convenient way for you and our staff to effectively communicate. Not only does this handy tool reduce your stress, it gives you immediate access to track everything about your style choices, available upgrades, final decisions, budget, questions asked, documents, photos and more!

Are You Ready to Map Out a Path to Building a Custom Home?

Carroll Construction is a family-owned, Louisiana-based residential home builder that specializes in building custom houses. After generations of constructing beautiful, upscale homes for incredible clients, we realized that most people can't find sufficient resources that explain the process of building a home from concept to completion.

That's why we are dedicated to ensuring every client has the information and tools needed to proceed with building a custom home you will love, tailored to your specifications using quality materials and impeccable workmanship.

Article by Robert Carroll

Robert is a NAHB Certified Graduate Builder with Carroll Construction. Robert joined the team in 2007 after graduating from L.S.U. with a degree in Construction Management. Now as Chief Operating Officer, Robert Carroll is extremely active in the local builder community, a leader in the LHBA, and is an avid supporter of charity and community causes inside the Greater Baton Rouge area.