Building a new home can be an extremely rewarding, educational, and exciting experience. However, the entire experience is often soured due to one or more pitfalls that result in unnecessary expenses, delays caused when steps are taken out of order, or (in a worst case scenario) the entire process coming to an abrupt halt.

But with expert insight about what to expect during the planning phases, you may be able to either avoid the obstacles, or be more prepared to deal with unanticipated surprises. This article reveals 3 common mistakes taken by real-world clients, plus the tips on how you can avoid making those same mistakes.

Common Mistake #1:

Contacting a Builder or Realtor BEFORE Determining Your Budget

Anyone in the market to build a new home understands that they need to involve a Builder or Realtor. So, when folks are in the early stages of the building process, the first instinct is to reach out to a real estate professional for a consultation, even before knowing the basic details of what they want their new home to look like, the general square footage, or even where it would be built. Here's the pitfall: neither a builder nor a realtor will be able to offer much guidance without knowing what size, style & location of a home you want. And, without that information, you cannot truly determine what your budget will allow. Many people are understandably nervous about revealing their budget goals so early in the process, but the reality is that this information will help determine the feasibility of your project and provide the context for what size and quality home you will be able to build.

How To Avoid The Mistake

Instead of initially reaching out to a builder or realtor, your first calls should be to a Financial Institution such as a Mortgage Originator, Bank, or Credit Union. These lenders will help you to determine a feasible budget based upon your Income and Outstanding Debt.

A knowledgeable lender will also be able to provide information about the different types of loans available to you as well as provide you with an idea of how much your monthly note might be. Keep in mind that not all home loans are created equal. Mortgage loan products vary between different financial institutions, therefore we encourage you to research and interview multiple lenders to find the loan product and terms that work best for you. The financial institutions you interview will provide a potential maximum amount they will lend you, but the ultimate decision in how much you are comfortable borrowing rests with you. Once you have that amount, you'll then be ready to proceed to the next step.

Common Mistake #2:

Having Plans Drafted Before Checking The Current Cost of Construction

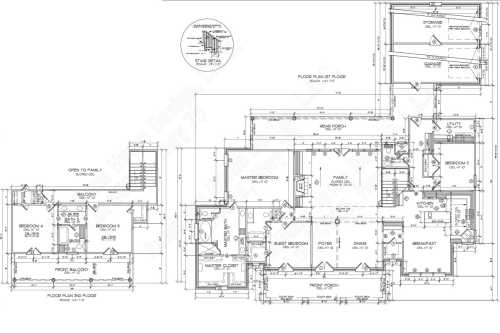

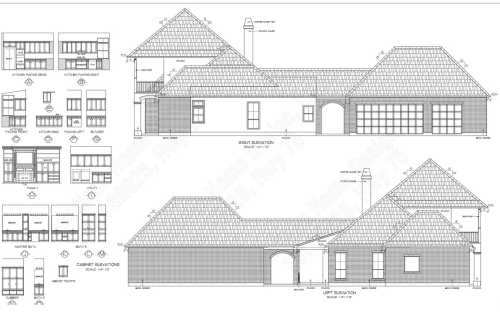

In the absence of proper guidance, people in the early planning stages of building a house tend to skip many of the less obvious - yet quite important - fundamental steps of the process. As a result, first-time planners often jump right into having the home designed and get a set of house plans drawn up even though they have no accurate guidance as to how much it will ultimately cost. This becomes a major problem because, (a) construction plans can cost thousands of dollars to complete, and (b) cost even more to change completed plans. To make matters worse, if significant design changes are necessary, it may result in the need to completely re-draw the plans...which means purchasing an entirely new set of plans!

How To Avoid The Mistake

While it is impossible for anyone to provide an accurate quote or price breakdown without the house plans, most builders have an idea of the average current costs per square foot of living area. Our advice is to find a builder whose style of homes appeal to you, and then have a conversation about the home you wish to build. Be prepared for a wide ranging quote to allow for flexibility, especially if you select a complex design, have luxurious tastes in finishes, or have a complicated site for construction.

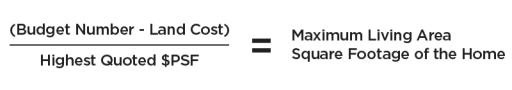

We suggest using the highest price-per-square-footage quote as the basis for determining the square footage of the home. Remember to consider the land costs as well. For example, if you speak with the contractor and are told that the current average pricing is between $130 psf and $145 psf (per square foot), you should take your ultimate budget number, subtract out the price of the land and divide it by the highest price per square foot quoted. The formula will look something like this:

Using this method will give you the flexibility to have the special amenities you want, while not “over-designing” the project. Then, if the project is quoted under your budget, you’ll have the opportunity to either save or splurge on some of the things on your wish list!

One more tip to remember before we move on, some companies may quote their homes based upon the price per TOTAL Square footage of the Home. This is a completely different number and will sound much lower than competitors. The important thing to remember is that the industry standard is to use the Living Area Square Footage. Stay tuned for a future blog post on the difference between these two methods of reporting price!

Common Mistake #3

Purchasing Land Before Doing Knowing Flood Zones, Restrictions, Clearing Costs and Local Ordinances

We are often contacted by folks who have already purchased land without understanding the what all is involved with preparing the land for construction or what all will be required before they can build a home. Sometimes they are told that the property is not in a flood zone only to find out later that the flood zones had changed without the knowledge of the previous owner. Other clients have purchased land expecting to build a certain type of custom home, only to later find out that the neighborhood/community has restrictions on what size home can be built or what types of finishes may be required on the exterior. Ultimately, those adapting to those restrictions could add significant and unexpected costs to the construction.

How To Avoid The Mistake

Tips on avoiding this mistake is to always hire a surveyor to prepare a Proposed Elevation Certificate (PCE), or obtain a recently completed PCE, before purchasing any land in areas where higher risk flood zones are present. This will be money well spent if it prevents you from unexpectedly incurring potentially tens of thousands of dollars in dirt work! Even if you do find that the property needs to be built up, it will give you the information to possibly negotiate a better price on the land and offset the preparation costs.

If you are planning to purchase a lot in a subdivision, be sure to thoroughly review the building restrictions before your purchase. Restrictions will often determine both the style of home and the required amenities for the exterior of the home and will require annual home owner association dues to be paid. Read a comprehensive list of considerations for the many types of land.

Gather All the Tips & Tricks Possible

While there are many possible pitfalls that you may encounter before you even begin building, it helps to have the right answers to help you navigate the process successfully. If you are looking for more tips on how to avoid spending money on missteps, be sure to check out Carroll Construction's Frequently Asked Question. Building a new home should be a enjoyable process and you don't have to make the same mistakes as others. A little preparation and education will give you the tools to help you succeed!