How Construction Loans Work in Louisiana (What Lenders Expect)

If you’re planning to build a custom home in Louisiana, understanding how construction loans work is essential. These loans are different from standard mortgages and come with unique requirements. Choosing an experienced builder early can speed approval by connecting you with lenders they already know and trust.

What is a Construction Loan?

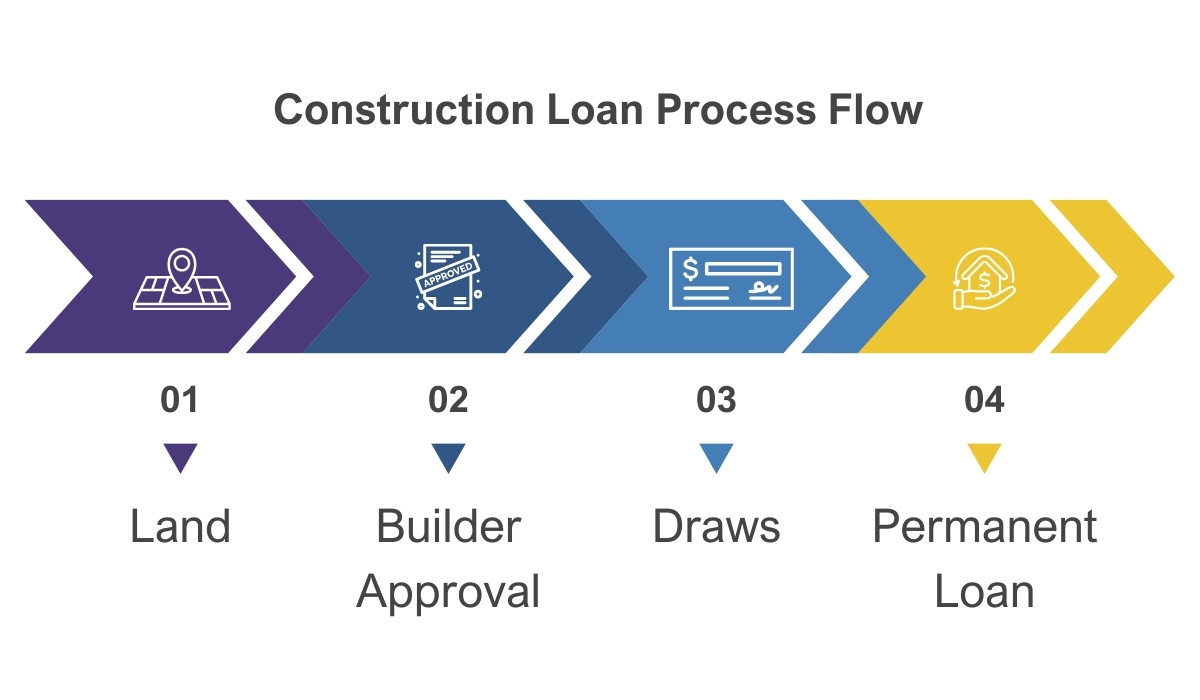

A construction loan finances the building of a new home by releasing money in stages as work is completed.

Loan terms typically range from 6–12 months.

The lender often has to approve your builder before closing.

Funds are disbursed only after each phase of construction is inspected.

During construction, you usually pay interest only on the funds drawn.

When construction ends, the loan is paid off with a permanent mortgage.

Two Main Loan Structures

Construction-to-Permanent Loans (One-Time Closing)

Combines construction financing and the permanent mortgage into a single loan.

You only pay one set of closing costs.

Interest-only payments during construction.

Converts into a permanent loan (usually conventional) once the home is finished.

Lenders typically finance 80–95% of the home’s value (LTV), so you’ll need 5–20% down.

Rates are often slightly higher than other products to reduce risk for the lender.

Stand-Alone Construction Loans

Two separate loans: one for construction, another for the permanent mortgage.

Often used by homeowners who plan to sell their current home to free up cash.

Allows for a smaller initial down payment.

Requires two closings (two sets of fees).

Permanent loan rates usually cannot be locked in at the start of construction.

However, experienced lenders may be able to help you lock in early if your builder provides a prepared construction schedule and can reasonably anticipate the closing date.

Without this, you risk higher rates if the market shifts before permanent financing is secured.

Permanent financing is not guaranteed if your financial profile changes during construction.

How Raw Land and Lots Affect the Loan

Owning your land outright makes loan approval easier and reduces costs. If you don’t own land yet:

Be aware of zoning restrictions and subdivision rules.

Lenders may require a survey and appraisal of the property.

Some have additional stipulations for raw land or non-subdivision parcels.

For example, if you own a very large tract of land, your lender may require you to subdivide a smaller parcel specifically for the construction loan. In our recent experience, lenders often limit the loan parcel to five acres or less. This helps them control the appraisal and collateral value tied directly to the home you’re building.

If you plan to build on raw land, research thoroughly and ask questions up front so you understand any additional requirements.

Documents Required by Lenders

Construction financing carries more risk for lenders, so they require detailed documentation. Be prepared to provide:

Standard Personal & Financial Documents

- Social Security numbers for all borrowers

Proof of employment for the past 2+ years

Income verification (pay stubs, W-2s, or tax returns)

Self-employment documents if applicable (P&L, 2 years of returns)

Residence history for the past 5 years

Bank, savings, and investment statements

Credit report and any supporting information

Gift letters for down payment assistance

Other relevant documents (divorce decrees, rental income statements, etc.)

Documents the Builder Provides

- Detailed material specifications

Professional references

Proof of license and insurance

Adequate coverage for construction risks

Home Construction Documents

- Final building plans

Written budget with phase-by-phase payments

List of prepaid items and how they were applied

Plat map or survey

Proof of land ownership (if applicable)

Signed contract between you and the builder

Your lender may require additional documents depending on zoning or floodplain issues.

Final Thoughts

A construction loan is an excellent way to turn your vision of a custom home into reality, but it comes with unique rules and requirements. By choosing an experienced builder and preparing documents in advance, you’ll move from planning to construction with fewer surprises.

Frequently Asked Questions about Construction Loans in Louisiana

A construction loan is short-term financing that pays for your home to be built. Funds are released in stages, called draws, as work is completed. Once construction is finished, the loan typically converts to a long-term mortgage.

Yes. Lenders expect you to own or be under contract for the land. You’ll also need a preliminary budget, plans, and a builder selected before approval.

The lender pays your builder in milestones—such as slab, framing, mechanicals, and finishes—after inspections. You only pay interest on the funds that have been drawn.

Most lenders require between 5% and 20% of the project cost. Existing equity in your land can often count toward the down payment.

Expect income and asset verification, the construction contract, plans and specs, a detailed budget, builder credentials, and an appraisal based on the plans.

In most cases, permanent loan rates can’t be locked in at the start. However, an experienced lender may allow you to lock in early if your builder provides a detailed construction schedule and anticipated close date.

Some lenders may require you to subdivide out a smaller parcel — often five acres or less — for the construction loan. This keeps the loan tied directly to the home site rather than the entire tract.

Some lenders allow owner-builder loans, but requirements are strict. Most prefer a licensed, insured builder with a fixed-price contract to reduce risk.

Ready to Plan Your Build?

Our BIDS™ process helps align plans, budgets, and lender requirements so you can move forward with confidence.